Federal income tax plus fica

Finally add 8370 and 195750 to get your total FICA taxes. Federal Insurance Contributions Act FICA The Federal Insurance Contributions Act FICA imposes a tax on both employees and employers to fund Social Security and.

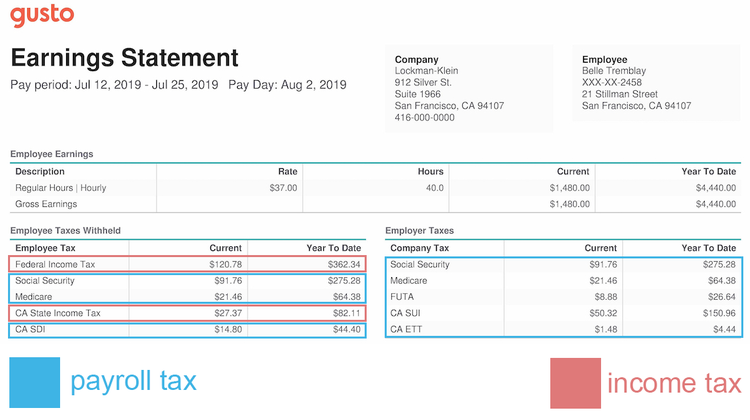

Payroll Tax Vs Income Tax What S The Difference

Based On Circumstances You May Already Qualify For Tax Relief.

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

. The FICA tax and federal. So a tax calculator would show you the sum of the 10 paid on the first 9525 95250 plus the 12 taxed onto the remaining income 2817. The FICA tax is actually made up of two separate taxes.

The Social Security tax and the Medicare tax. File a federal tax return as an individual and your combined income is. 10 12 22 24 32 35 and 37.

If you have a combined income but are filing as an individual your benefits arent taxed if your benefits are below 25000. The federal income tax system is progressive so. Then multiply 135000 by 145 00145 to get your Medicare taxes.

FICA is only collected on salary or net profit for self-employed but not on interest capital gains lotteries etc. Again this percentage includes 62 toward Social Security and 145 toward Medicare tax. Taxes under the Federal Insurance Contributions Act FICA are composed of the old-age survivors and disability insurance taxes also known as social security taxes and the.

Federal Income tax is paid on all types of income at different rates. FICA is not included in federal income taxes. These are the rates for.

No the IRS does not allow you to deduct FICA from your income taxes. FICA is separate from the federal income tax. Income in America is taxed by the federal government most state governments and many local governments.

If your income is above that but is below 34000 up to half of. The FUTA tax rate is a flat 6 but is reduced to just 06 if its paid on time. Is Fica Included In Federal Income Tax.

To calculate FICA tax simply multiply gross earnings by 765. Ad See If You Qualify For IRS Fresh Start Program. Overview of Federal Taxes.

Free Case Review Begin Online. FICA is comprised of the following. However Virgin island employers must pay 24 to the government since this territory owes the US government.

In this case your estimated bill for federal. While both these taxes use the gross wages of the employee as the starting point they. While both federal income tax and FICA taxes are employment taxes that employers must withhold from an employees paychecks there are some fundamental.

FICA may be listed on your paystub under taxes or withholding The. Where Is FICA on my Paystub. Your bracket depends on your taxable income and filing status.

FICA taxes require withholdings from an employees wages plus an employer paid portion of the taxes. If you earn more. There are seven federal tax brackets for the 2021 tax year.

Between 25000 and 34000 you may have to pay income tax on up to 50 percent of your benefits.

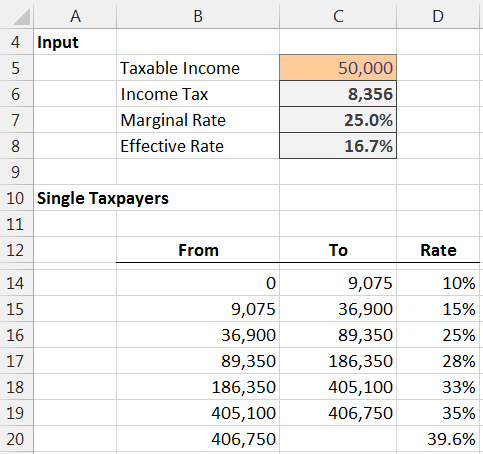

Income Tax Formula Excel University

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

What Is Fica Tax Understanding Payroll Tax Requirements Freshbooks Resource Hub

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How Fica Tax And Tax Withholding Work In 2022 Nerdwallet

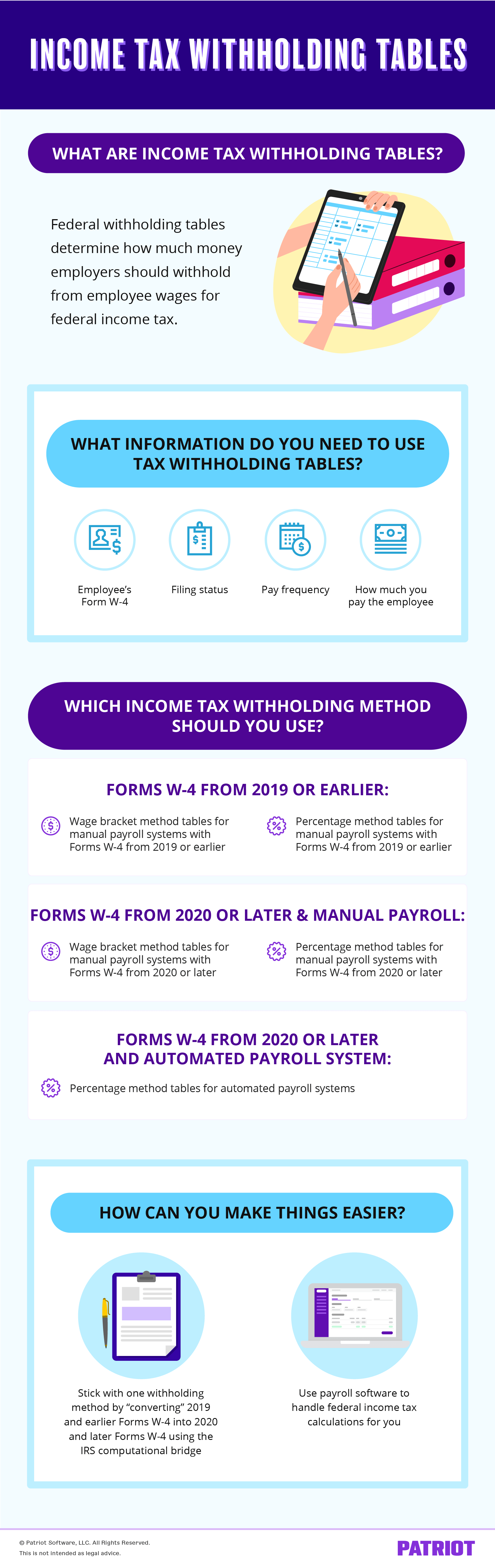

2022 Income Tax Withholding Tables Changes Examples

Understanding Your W 2 Controller S Office

How Do State And Local Individual Income Taxes Work Tax Policy Center

/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg)

Why Is There A Cap On The Fica Tax

2022 Income Tax Withholding Tables Changes Examples

Income Tax Formula Excel University

What Are Employer Taxes And Employee Taxes Gusto

2022 Federal State Payroll Tax Rates For Employers

How Do State And Local Individual Income Taxes Work Tax Policy Center

Do You Need To File A Tax Return In 2022 Forbes Advisor

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation